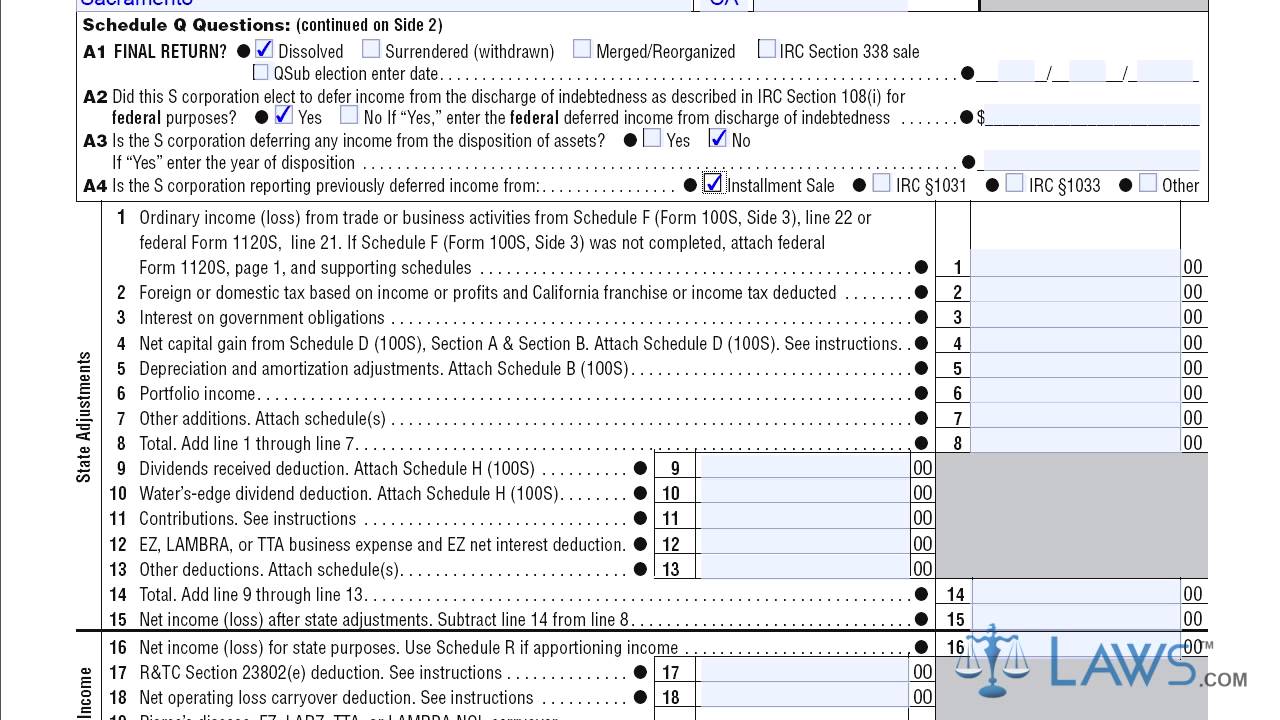

All California S corporations and LLCs companies treated as S corporations for federal, should file Form 100S (California S Corporation Franchise or Income Tax Return). Q. When Do I File My Corporation Return? A. Form 100S is due on the 15th day of the third month after the close of the taxable year. If the due date falls on a Saturday, Sunday …

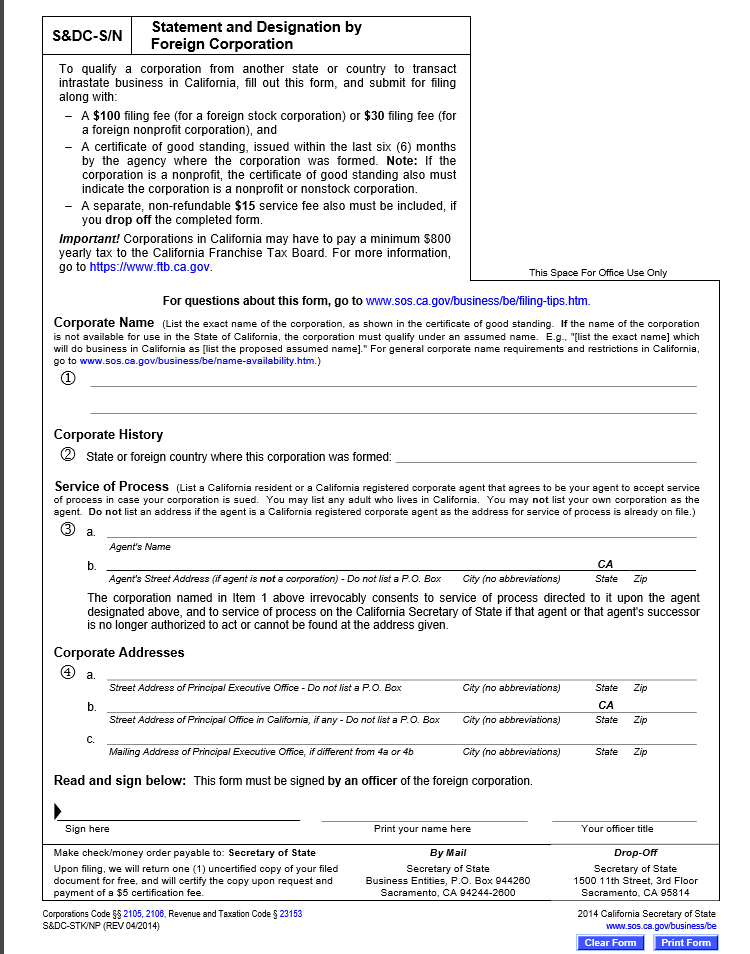

Free California Statement and Designation by Foreign Corporation | Form S&DC-S/N

California taxes S Corps at a rate of 1.5% for all California-sourced income. You’ll also need to file Form 100S every year, and pay the annual $800 minimum franchise tax to maintain your status as an S Corp. The franchise tax applies even if your business is inactive or running at a loss.

Source Image: en.wikipedia.org

Download Image

There is a difference between how California treats businesses vs federal. For example, an S Corporation’s 2023 tax return due date is: Calendar tax year: March 15, 2024; Fiscal tax year: the 15th day of 3rd month after end of their tax year; If the due date falls on a weekend or holiday, you have until the next business day to file and pay.

Source Image: dreamstime.com

Download Image

Form a California S Corporation in 12 Steps – YouTube A small business corporation elects federal S corporation status by filing federal Form 2553 (Election By a Small Business Corporation) with the Internal Revenue Service. When a corporation elects federal S corporation status it automatically becomes an S corporation for California. The corporation can elect to remain a California C corporation

Source Image: incorporated.zone

Download Image

How To File S Corporation In California

A small business corporation elects federal S corporation status by filing federal Form 2553 (Election By a Small Business Corporation) with the Internal Revenue Service. When a corporation elects federal S corporation status it automatically becomes an S corporation for California. The corporation can elect to remain a California C corporation File Online. Limited Liability Company. Corporation. Trademark. Uniform Commercial Code . Call Us (916) 653-6814. Receive Updates Sign up for e-updates. Write Us … Shirley N. Weber, Ph.D., California Secretary of State 1500 11th Street Sacramento, California 95814 Office: (916) 653-6814.

Statement of Information (What Is It And How To File One)

California Franchise Tax Board Certification date July 1, 2023 Contact Accessible Technology Program. The undersigned certify that, as of July 1, 2023, the website of the Franchise Tax Board is designed, developed, and maintained to be accessible. This denotes compliance with the following: California Government Code Sections 7405, 11135, and … The Accountant’s Entity Guidebook – CPA Practice Advisor

Source Image: cpapracticeadvisor.com

Download Image

Pinterest California Franchise Tax Board Certification date July 1, 2023 Contact Accessible Technology Program. The undersigned certify that, as of July 1, 2023, the website of the Franchise Tax Board is designed, developed, and maintained to be accessible. This denotes compliance with the following: California Government Code Sections 7405, 11135, and …

Source Image: pinterest.com

Download Image

Free California Statement and Designation by Foreign Corporation | Form S&DC-S/N All California S corporations and LLCs companies treated as S corporations for federal, should file Form 100S (California S Corporation Franchise or Income Tax Return). Q. When Do I File My Corporation Return? A. Form 100S is due on the 15th day of the third month after the close of the taxable year. If the due date falls on a Saturday, Sunday …

Source Image: articlesofincorporation.org

Download Image

Form a California S Corporation in 12 Steps – YouTube There is a difference between how California treats businesses vs federal. For example, an S Corporation’s 2023 tax return due date is: Calendar tax year: March 15, 2024; Fiscal tax year: the 15th day of 3rd month after end of their tax year; If the due date falls on a weekend or holiday, you have until the next business day to file and pay.

Source Image: m.youtube.com

Download Image

S-1 California Franchise Tax Board Certification date July 1, 2023 Contact Accessible Technology Program. The undersigned certify that, as of July 1, 2023, the website of the Franchise Tax Board is designed, developed, and maintained to be accessible. This denotes compliance with the following: California Government Code Sections 7405, 11135, and …

Source Image: sec.gov

Download Image

Form 100S California S Corporation Franchise or Income Tax Return – YouTube A small business corporation elects federal S corporation status by filing federal Form 2553 (Election By a Small Business Corporation) with the Internal Revenue Service. When a corporation elects federal S corporation status it automatically becomes an S corporation for California. The corporation can elect to remain a California C corporation

Source Image: youtube.com

Download Image

California Governor Signs Bill Requiring Zero-Emissions School Bus Purchases by 2035 – School Transportation News File Online. Limited Liability Company. Corporation. Trademark. Uniform Commercial Code . Call Us (916) 653-6814. Receive Updates Sign up for e-updates. Write Us … Shirley N. Weber, Ph.D., California Secretary of State 1500 11th Street Sacramento, California 95814 Office: (916) 653-6814.

Source Image: stnonline.com

Download Image

California Governor Signs Bill Requiring Zero-Emissions School Bus Purchases by 2035 – School Transportation News California taxes S Corps at a rate of 1.5% for all California-sourced income. You’ll also need to file Form 100S every year, and pay the annual $800 minimum franchise tax to maintain your status as an S Corp. The franchise tax applies even if your business is inactive or running at a loss.

Form a California S Corporation in 12 Steps – YouTube Form 100S California S Corporation Franchise or Income Tax Return – YouTube California Franchise Tax Board Certification date July 1, 2023 Contact Accessible Technology Program. The undersigned certify that, as of July 1, 2023, the website of the Franchise Tax Board is designed, developed, and maintained to be accessible. This denotes compliance with the following: California Government Code Sections 7405, 11135, and …